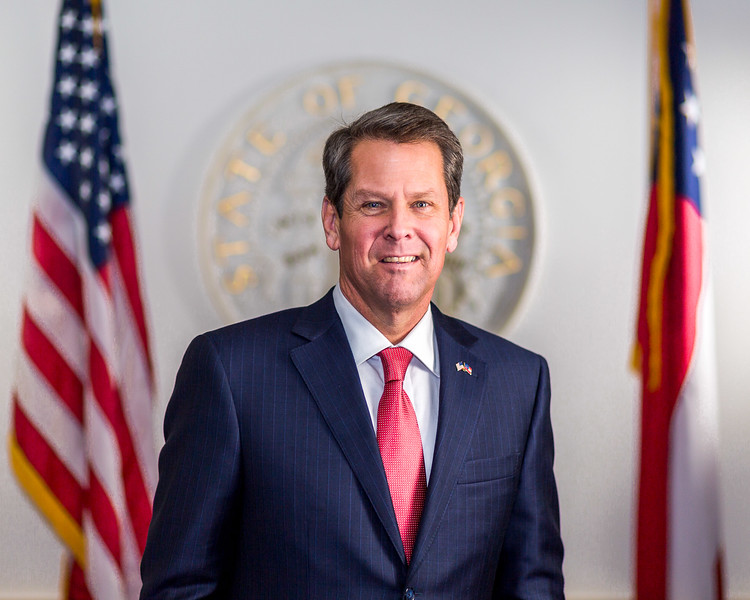

ATLANTA – Gov. Brian Kemp wants to use a record state budget surplus to cut taxes.

The Republican governor proposed $1.6 billion in tax refunds Wednesday worth $250 for state income tax single filers and $500 for joint filers.

“We should continue to fund our priorities but also be good stewards of that taxpayer money,” Kemp told Georgia political and business leaders during the annual Eggs and Issues breakfast sponsored by the Georgia Chamber of Commerce.

Kemp said the record $3.7 billion budget surplus the state posted at the end of the last fiscal year in June resulted from Georgia’s ability to recover quickly from the recession brought on by the coronavirus pandemic. While some states shut down businesses during the pandemic’s early months, Kemp chose to keep Georgia’s economy open.

“We chose hope over fear, freedom over lockdowns,” he said. “As a result, our state led the nation in economic recovery.”

While the governor’s tax refund plan likely will enjoy smooth sailing in the Republican-controlled legislature, an Atlanta-based think tank criticized it as overly broad.

“Public opinion data shows that what most Georgians want is not a smaller one-time payment for all taxpayers, but strategically targeted tax relief for those who need it the most,” said Danny Kanso, senior policy analyst with the Georgia Budget and Policy Institute. “State leaders should reconsider the approach to one-time payments and choose a lasting solution that would benefit those hardest hit by the pandemic.”

Kemp also announced plans to reverse the budget cuts to higher education the state imposed during the Great Recession of the late 2000s and early 2010s.

He said he will ask the General Assembly for $262 million to remove “institutional” fees the University System of Georgia slapped on students during that economic downturn and $25 million to increase the HOPE Scholarship program’s coverage to at least 90% of tuition costs at the state’s public colleges and universities.

The mandatory institutional fees, which were not earmarked for specific purposes such as athletics, have been a major source of complaints by students and their parents. The lottery-funded HOPE program, which used to provide full tuition coverage for eligible students, was reduced in 2011 because growing student enrollment was failing to keep pace with HOPE revenues.

Kemp also announced legislation will be introduced on his behalf during the 2022 General Assembly session to exclude from taxes retirement income earned by members of the military.

Also during the Eggs and Issues breakfast, Lt. Gov. Geoff Duncan pitched his proposal for a $250 million state tax credit to raise money to support law enforcement.

Georgia House Speaker David Ralston said he will introduce a comprehensive bill aimed at improving mental health services in Georgia by, among other things, providing parity to mental health-care workers.

“For too long, our state has ranked among the worst in the nation for delivering mental-heath services,” said Ralston, R-Blue Ridge. “That is a distinction that’s going to change.”

Wednesday’s Eggs and Issues breakfast was the first held inside Midtown Atlanta’s Fox Theatre and the first to be held in person since before the pandemic struck Georgia nearly two years ago.

This story is available through a news partnership with Capitol Beat News Service, a project of the Georgia Press Educational Foundation.