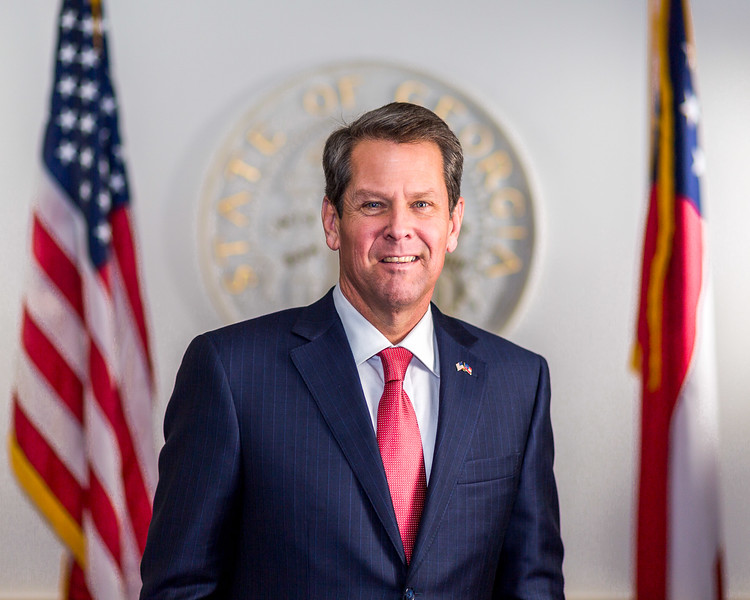

ATLANTA – Gov. Brian Kemp signed the largest tax cut in Georgia history Tuesday, legislation he said when fully implemented will save a family of four with an annual household income of $60,000 more than $600 a year.

The bill, which the Republican-controlled General Assembly passed early this month, will gradually reduce the state income tax rate from 5.49% to 4.99% over six years, starting with the 2024 tax year. The current tax rate is 5.75%.

Kemp and legislative Republican leaders pushed through the election-year tax cut at an opportune time, when the state is sitting on a huge budget surplus coming out of the pandemic.

“Government should take in the least amount possible needed to serve the people properly,” Kemp said during a signing ceremony in Bonaire, the hometown of Georgia House Ways and Means Committee Chairman Shaw Blackmon, the tax cut bill’s chief sponsor. “Taxpayer dollars are the people’s money, not the government’s.”

Kemp said the income tax cut represents the long-term component of a tax reduction package lawmakers approved this year, including a one-time $1.1 billion tax refund, a temporary suspension of the state’s gasoline sales tax to put a dent in rising pump prices, and legislation he signed last week exempting military retirees from the state income tax.

“We can’t fix everything Washington has broken,” he said. “But we’re doing our part to lessen the pain on people’s wallets in Georgia.”

During the legislative debate, Democrats argued most of the income tax cut’s benefits would go to the wealthiest Georgians.

“The shift to a flat tax structure would weaken the state’s ability to respond to the needs of its residents, while also exacerbating racial and income inequality by widening the gap between the wealthiest and all other Georgians,” said Danny Kanso, senior tax and budget policy analyst with the progressive Georgia Budget and Policy Institute.

“The General Assembly should require those at the top to pay their fair share with a graduated income tax and consider rolling back itemized deductions, corporate subsidies and other tax breaks that disproportionately benefit the wealthiest.”

On the other hand, former U.S. Sen. David Perdue, who is challenging Kemp in next month’s Republican gubernatorial primary, is calling for eliminating the state income tax entirely.

U.S. Rep. Nikema Williams, D-Atlanta, chairman of the Democratic Party of Georgia, criticized Kemp Tuesday for not declaring publicly whether he supports abolishing the tax.

This story is available through a news partnership with Capitol Beat News Service, a project of the Georgia Press Educational Foundation.