ATLANTA – Each of the three main credit rating agencies has given Georgia a rating of AAA with a stable outlook, which will yield savings when the state sells bonds next week.

The state will accept bids June 22 on general obligation bonds to fund $754 million in capital projects, primarily for K-12 and higher education, public safety and economic development.

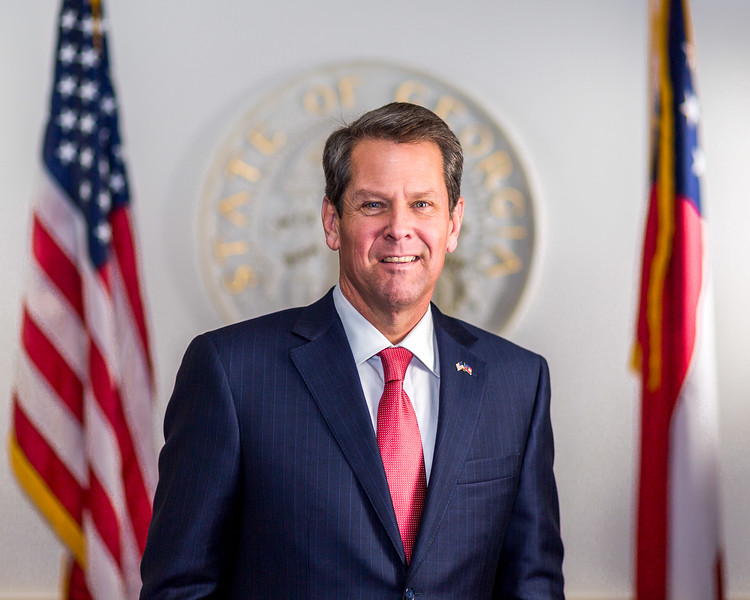

“Securing the highest possible state bond ratings for yet another year is the result of decades of conservative state leadership and our balanced approach to protect both lives and livelihoods throughout the COVID-19 pandemic,” Gov. Brian Kemp said Monday.

“By keeping our state open for business, we have brought in record levels of jobs and investments all throughout the state.”

Of the states that issue general obligation bonds, only nine received AAA ratings this year from FitchRatings, Moody’s Investors Service, and S&P Global Ratings.

The ratings agencies cited the strength of Georgia’s economy as factors contributing to the AAA ratings. Specifically, they pointed to low unemployment, full funding of the state’s “rainy-day” reserves, a balanced approach to primary revenue sources, and consistent funding of obligations.

“The [AAA] rating reflects the state’s large and diverse economy, population and employment growth that outpaces the nation, solid reserves and liquidity, strong fiscal governance and low direct leverage from debt, pension and OPEB (Other Post-Employment Benefit) liabilities,” Moody’s wrote.

“Very strong revenue performance year-to-date in fiscal 2022 will fund the state’s recently enacted tax cuts – including a gas tax holiday, one-time rebates and permanent cuts to income tax rates – with limited impact on financial reserves.”

This story is available through a news partnership with Capitol Beat News Service, a project of the Georgia Press Educational Foundation.